By: Timothy Silvers

June 2, 2006

Since gold and silver have both corrected, is it time to jump back in? In my last market update on May 18, I said that I’d be more comfortable going long on silver if gold would have a healthy correction back to its 50 day moving average (MA). Yesterday gold closed below that level, but today it gained back and closed over $636, several dollars above the 50 day MA. Silver also had a volatile week and hit a low of $11.63 on Thursday before recovering and ending up back above $12 today. The question that seems to be on everyone’s mind is: Will the 50 day MA hold for gold and silver or will they continue to correct and retest the 200 day MA? Let us look at a few graphs and see what clues we can find.

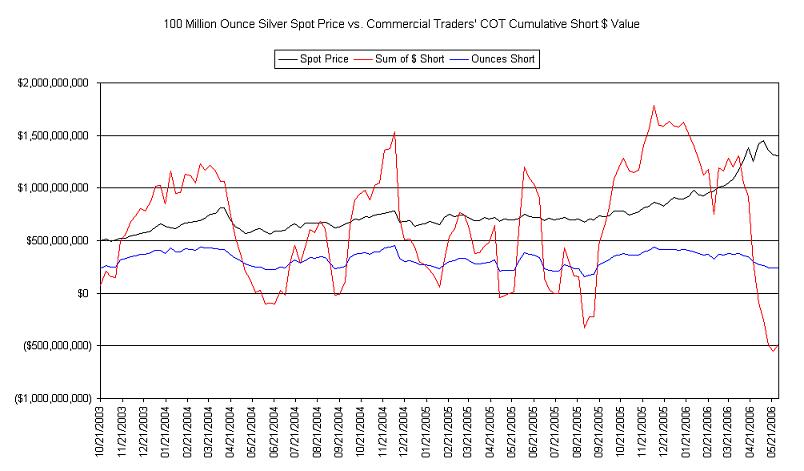

The latest COMEX Commitment of Traders data related to the short position of the Commercial Traders (commercials) shows that the commercials have closed out a much of their short position. The graph below shows that the dealer short activity bottomed out last week and they have slightly increased their short position as of Tuesday. In the past two and a half years, there have been seven times that the commercials’ Sum of $ Short trend has reached or approached zero. You would have profited if you had purchased silver at any of these times in the past. Using this graph as an indicator, it would appear likely that we are at another good buying point for silver

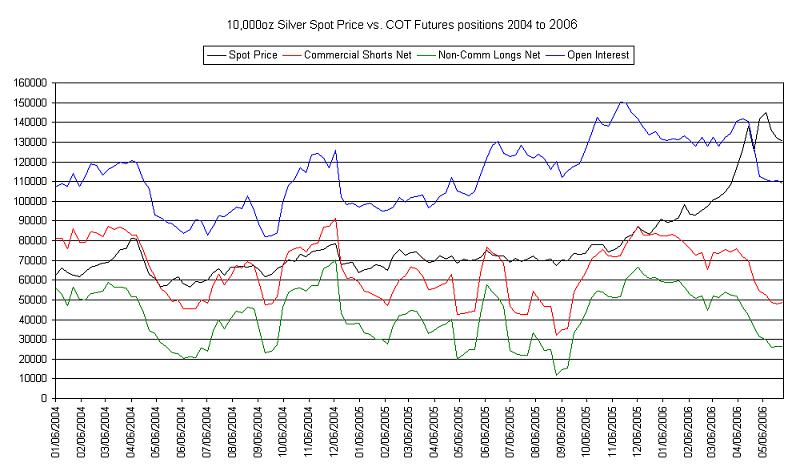

Another graph that shows similar information also shows the net long position of the non-commercial investors, who are mainly technical trading funds. The dips in the non-commercial long and the commercial short positions coincided perfectly in the past with excellent times to buy silver. You cannot help but notice that the technical trading funds’ long position rises and falls with the shorting activity of the commercial traders. This is an indication of what Ted Butler has been describing for years, that the funds are the counter parties that the commercials use to lock in their profits when they cover their short positions. This year, the commercials’ strategy appears to have backfired, as they had to have suffered large loses because the price of silver did not correct below the price at which they added most of their short position.

Obviously, these graphs do not prove that silver will rise further in price, but they do indicate that the commercials do not have much “ammunition” (many open short contracts) to use to push down the price. I have mentioned the possibility several times of a silver correction back to the 200 day MA. However, in the past three years, the only time that silver corrected back that far was when the commercials covered large quantities of short contracts. Since they are down to historically low levels of open shorts, I do not think that the commercials will have a large negative impact on the price of silver in the near future.

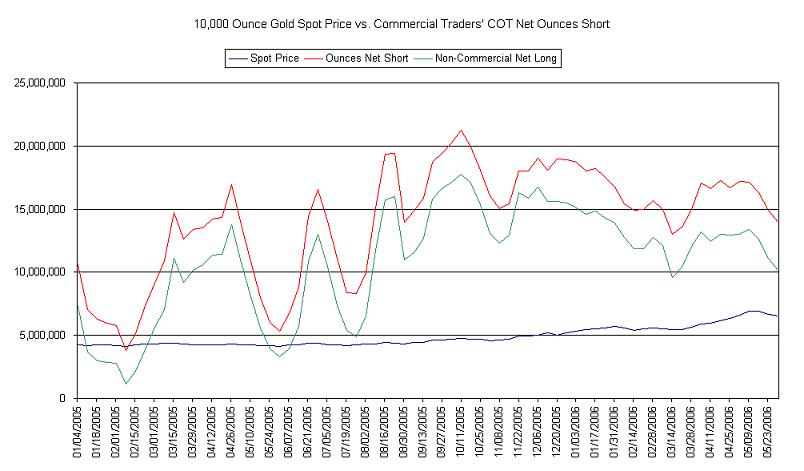

It appears that gold is the important metal to watch right now to predict what will happen to the silver price in the short term. The graph below for gold shows the commercial short and non-commercial long positions in gold since January 2005. We can see that the open short position has grown over the past year and a half, but is again trending downward. In 2005, there was a 75% correlation between the commercials’ gold short position and the price of gold. Like silver, there is no correlation so far this year. However, if you look at the gold price at the times when there were reductions in the overall short position, it looks like it is a good time to buy gold when the dips start to move back up. With the additional selling we had this week after Tuesday, I would expect to see further declines in open commercial short and non-commercial long positions when they are reported next Friday.

Summary

As I have mentioned before, I strongly advocate having a physical position of silver paid for in full, without leverage, and stored in a secure location. If you have not established that position yet, then I do not recommend trying to time the market to get in at the best price. We are likely to see more volatility up and down in the next few months. Dollar cost averaging your purchases is probably a good strategy. I would suggest that you invest an equal portion of your funds each week until you have established a solid core position of physical silver. I have been using this method myself to buy more bullion with the cash that I had set aside waiting for a pullback. I will continue to buy more on price weakness until I am fully invested.

Although I have purchased more bullion and some mining shares, I have not jumped back into a long trading position yet because the indicators have not shown all the bullish signals that I discussed on May 18. Gold had a healthy and much needed correction this week but we need to see if it can maintain closes above its 50 day MA and if the RSI (14) increases back above 50 (currently at 44). If it continues to drop, then $600 is the next major support, followed by strong support around $575. As for silver, through today we have closed below the 50 day MA three days in a row. I am closely watching $11.70 to see if silver closes below this level. If it does close below $11.70, then the next area of support would be the gap at $11.10-$11.25. As with gold I want to see the RSI back above 50 (currently at 43) before I can be comfortable going long on a trading position. We had two false moves up in silver on 5/23 and 5/30 but it was not able to keep the upward momentum.

The price of silver and gold are highly depending on investor psychology right now and less dependent on the trading positions of the commercials. Dollar strength, peaceful resolution to the Iran nuclear issue, and further sell offs in copper, oil or other commodities, to name a few factors, could negatively impact the precious metals in the short term. Long term, I am as bullish as ever. Buy silver now while it’s still cheap and hold it until every waiter, cab driver and co-worker that you run into is talking your ear off about the next hot mining stock and how much money they are making on their silver and gold investments.

God Bless,

Timothy Silvers

Timothy Silvers is an independent analyst who has been following the silver market since the late 1990’s. Yes, Silvers is his real last name, so it only makes sense that he follows the silver market. If you are interested in more of his analysis, please visit his website at www.silverbrothers.com

Disclaimer: This article represents the opinions and personal views of Timothy Silvers and is not intended to be investment advice. If you choose to use this analysis for your personal trading, Timothy Silvers assumes no liability for the direct or indirect losses you may incur due to using this article to make your investment decisions. You are totally and completely responsible for your own investments. At any given time, Timothy Silvers or his friends and relatives may have positions in silver related investments that may or may not follow the recommendations contained in this article. The information in this article may not be completely correct and accurate. Even though Timothy Silvers has done his best to review the content and accuracy of this article, he is in no way liable or responsible for any mistakes or omissions.