- Monday, July 3rd

Short-term internal momentum for the silver stocks is still rising, a fact that contributed to the across-the-board rally in the silver stocks last week. Internal momentum as measured by the SS HILMO indicators (silver stock hi-lo momentum), which measure the rate of change in the net new highs among the actively traded silvers, is improving. The SS HILMO indicators havenít gone up into positive territory yet, but since they are all upward-slanting it reflects a short-term upward bias in the silver stocks that should allow for some further rally before the next short-term cycle peak.

As you can see in the chart below, the 20-day SS HILMO indicator is set to continue rising by virtue of the contraction in the number of silver, platinum and palladium stocks making new lows. Thatís good news for the white metal sector, short-term, and it should provide a positive internal momentum backdrop for the silver stocks. For the 5-day and 10-day HILMO indicators to continue rising in the next few days, however, there needs to be an expansion in the stocks making new 10-week highs. There are some stocks that have a chance at doing this. The following white metal stocks show the greatest relative strength and should be watched for new 10-week highs in the coming days: ECU Silver Mining (ECU:TSXV), Genco Resources (GGC:TSXV), Platinum Group Metals (PTM:TSX), Quaterra Resource Inc. (QTA:TSXV), Rio Tinto (RTP:NYSE), Sabina Silver Corp. (SBB:TSX), and Silver Wheaton (SLW:NYSE).

The XAU gold/silver rallied almost 2% in sympathy with the across-the-board leap on Thursday and Friday, closing at 143.57. The XAU met resistance on Friday precisely at its 60-day moving average at 144.50 while the AMEX Gold Bugs Index (HUI) likewise encountered resistance at its 60-day MA along with the XAUís leading indicator, Freeport Gold (FCX).

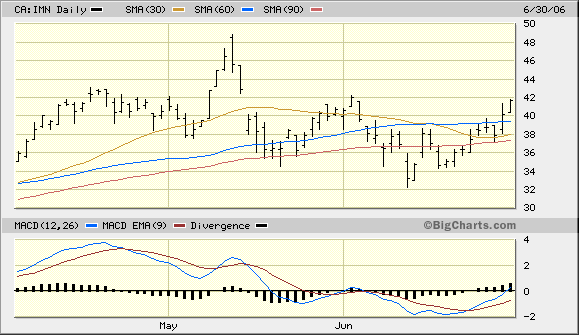

The question for the immediate term is whether XAU can overcome the 60-day MA and make higher highs before its next short-term cycle peak? Considering that the two other leading/confirming indicators for the overall gold/silver stocks sector have closed above their respective 60-day moving averages it stands to reason that XAU should be able to do the same. These other equities already above the 60-day MA include Silver Standard Resources (SSRI) and Inmet Mining (IMN:TSX). IMN in particular has a nice looking chart pattern with the 60-day and 90-day moving averages still rising at a fairly good rate of change in reflection of the lingering interim upward bias.

Now letís turn our attention to the broad stock market as a whole, specifically to the issue of market liquidity. The gold/silver stocks have traded in sympathy to a large extent with the broad market indices in recent months and what has been good for the general stock market (in the way of liquidity) has also been bullish for the precious metals stocks. With that in mind letís consider the following observation which was sent to me recently by an astute market observer:

"I just happened to check the latest Federal Reserve securities lending figures and I saw the huge amount of $7.8 billion on Friday [June 30]. And the rest of the week seemed to have numbers solid around $4 billion or so. Could this be a catalyst for the markets [to rally]? And if so, how much staying power might this influx of liquidity provide the markets?"

This is a good question and for a graphic representation of this increase in liquidity the Fed has injected into the market recently on a rate of change basis, we turn to our SECMO (securities lending momentum) series of indicators. Note the increase in the rate of change on a short-term basis in the chart to the left.

This shows a big improvement in the short-term trend of the Fedís securities lending operations (seclend). The securities lending volume released by the Fed this week was the highest total lending in several weeks, and in the past such an increase in lending has laid the groundwork for a rally in at least one or more of the major market sectors in the short term. The question asked here is if this increase in securities lending could possibly find its way to the precious metals stocks and allow for a continuation of the rally from late June. Since weíve already seen evidence that gold and silver stock internal momentum is short-term positive along with some relative strength in some areas of this sector, it stands to reason that any further increase in liquidity would benefit the strongest of these golds and silvers. Traders should especially pay attention to gold and silver stocks that are coming out of solid looking basing patterns, short-term, and have rising 200-day moving averages as well as rising 60-day and 90-day moving averages (the latter two being the sub-dominant interim moving averages for most actively traded stocks).

Clif Droke is the editor of the daily Durban Deep/XAU Report, a technical forecast and analysis of several leading gold and silver stocks, including DRDGold and the QQQ available at www.clifdroke.com. He is also the author of several books, including "Gold Stock Almanac 2006."