-- Posted 25 September, 2011 | | Discuss This Article - Comments:

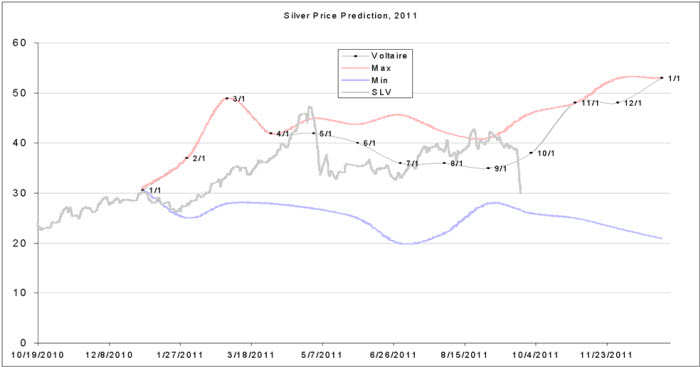

On December 31, 2010 I made a prediction for the price history of silver for 2011. I also asked for and received other predictions from readers of this article. The results are here:

Forget about the cliff dive last week.

Ask yourself, with Europe imploding, with the Chase, Citi, BAC and Goldman each holding more that $45T in derivative exposure ... does this make sense? Behind the scenes, the US Federal Reserve is doing a lot to keep the world's financial systems from imploding. But there are limits to debt. The solution in 2008 was to corrupt the Fed's balance sheet with bad debt. The only option now is to print.

We are about to see money printing unlike anything that the US Federal Reserve has contemplated before.

There are very few ways to protect yourself from what is about to happen. Silver is one of the best ways.

At this moment, single silver eagles are selling for between $38 and $39 each on e-bay. Odd lots of junk silver can be had for as little as $33 to $34 an ounce. Ten ounce bars can be had for between $35 and $38 an ounce. These prices are similar to what you will find at major online retailers, with the exception of the cheap junk silver (got to go bargain hunting on e-bay for that).

Here's an analysis that I did recently on primary or near primary silver producers, mostly in Mexico. I just updated the share prices for the close on Friday:

- click to enlarge -

If you believe that silver will be $50 an ounce next year, then these stocks are cheap. These are all producers and all of them are throwing off a lot of cash.

Of course, you are responsible for your own decisions.

by Voltaire

incitertrading.com

-- Posted 25 September, 2011 | | Discuss This Article - Comments: