|

-- Posted 25 April, 2011 | | Discuss This Article - Comments:

Source: SilverSeek.com

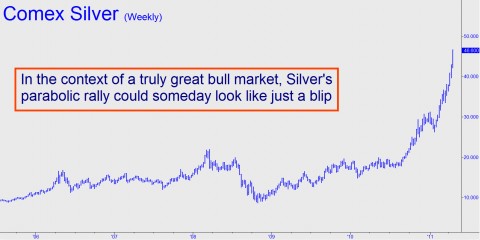

Bullion quotes continue to ratchet higher, even as silver bulls (of all people!) warn that the rally has come too far, too fast. Ahh, there’s that old wall of worry What could be more encouraging to long-term investors? For it is only when silver’s most ardent supporters become cocksure, loading up aggressively for the next supposedly inevitable rally, that the trend will perhaps be in jeopardy – and then presumably only fleetingly. For now, though, we need to remind ourselves that great bull markets are supposed to scare hell out of bulls and bears alike — just as this one has been doing since last autumn. Check out the amazing spike in Silver’s weekly chart below. While we wouldn’t attempt to argue that its parabolic pitch can be sustained indefinitely, we suspect that, no matter how ferocious the inevitable corrections yet to come, they will look relatively innocuous years from now. For it is only at that point that we will be able to see them in the context of a long-term bull market that will have achieved heights as yet unimagined by most investors.

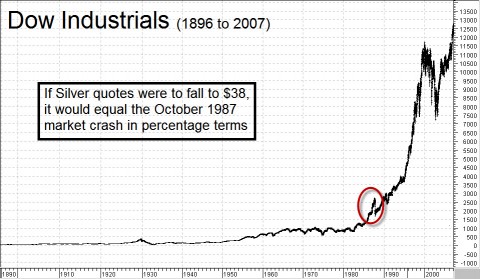

The chart may wind up looking much like one drawn today that shows the 1987 Crash. At the time, we thought the world was ending that Friday, October 16, as the Dow plummeted an unprecedented 108 points. To the amazement of all, and the devastation of many, that proved to be just a warm-up for Monday, when a 508-point collapse brought the blue chip average down to 1739 – a 22% drop. But look at the chart below and see if you can even find the ’87 crash. While it is more than a blip, for sure, in the visual context of the spectacular bull market that was to follow, it looks like no more than the healthy, corrective pause it turned out to be. If Silver futures were to get hit as hard in the weeks ahead, they’d find a bottom near $38. Hardly the end of the world. Moreover, we suspect that, just like in 1987, it could produce the best buying opportunity we might see for years to come.

In the meantime, there don’t appear to be any developments in the real world that might derail the bull market in precious metals. Some technicians that we respect are calling for a sustained upturn in the dollar, but we can’t find any evidence of it in the charts. And although, to be cautious, we routinely suspend our bearish skepticism whenever the Dollar Index hits an important new downside target as it did last week, we’ve yet to see a bounce with the kind of power it would take to end the dollar’s bear market. Indeed, the most bullish event we could imagine for the U.S. dollar would be the collapse of Spain’s sovereign debt, and with it the euro. The dollar would most surely spike higher on the news, but the move would probably be short-lived, if for no other reason than that Spain’s all-but-inevitable collapse has already been discounted. We could also see the dollar rising when Wall Street’s Mother of All Bear Rallies finally ends, as it conceivably could — any day. But the economic depression to follow would hardly be bullish for the dollar. And while it might help bring down America’s trade deficit, it would also deliver a blow to tax revenues that would coax forth even more dollar-depreciating stimulus from the Federal Reserve. Following Our Discipline As a practical matter, the best we can do for now is monitor gold and silver prices very closely whenever they reach our proprietary rally targets. Our current forecast leaves room for both to achieve at least somewhat higher highs before there’s reason for caution. (If you are not a subscriber but would like to access Rick’s Picks’ precise numbers and detailed trading instructions, click here for a free trial to the service. And if you want to learn more about our forecasting technique itself, click here.) As always, if the price targets should be easily exceeded, that will allow us to stick confidently with the trend. It is only when the corrective selloffs overshoot their respective targets that we might raise a yellow flag. So far, however, sellers have been unable to push either gold or silver beyond the midpoint of corrective patterns, and that is why we continue to urge subscribers to stay aboard.

-- Posted 25 April, 2011 | | Discuss This Article - Comments:

| |

|

|

Last Three Articles by Rick Ackerman

|

|  |

|

|