-- Posted 15 April, 2004 | | Source: SilverSeek.com

First thanks to StockCharts.com for the following charts…

Tuesday's sell off (April 13, 2004)

New York Spot Price

Metals Bid Ask Change Low High

GOLD 406.60 407.10 -13.20 -3.14% 404.10 416.10

SILVER 7.44 7.46 -0.57 -7.12% 7.32 7.84

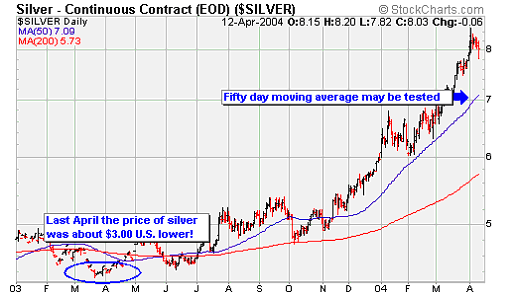

Today we saw a sharp sell off in silver. Those that have followed the silver marker closely know that silver is not only a smaller market than gold, but also moves in greater percentages both up and down. Gold was off three percent, but silver fell over seven percent!

From a longer term perspective we wish to remind readers of the fact that just one year ago silver was almost exactly three dollars (U.S. dollars) lower than yesterday’s close. Certainly in our view the longer term major trend is still UP, however this break of the recent parabolic move in silver prices is suggesting to us that a pullback to the seven dollar level could be expected.

For the Record we sent the following out to our paid subscribers, as silver moved above the $7.20 level.

“We did send an email alert out mid month anticipating a temporary top in the mining equities and since that time the major silver companies have traced out indecision patterns, meaning they have not continued to make new highs even though silver itself has continued to set new highs.

This usually precedes a correction in the price of the metal.

End quote.

Look at the chart above and note the channel formation from early 2004 until present. This pattern indicates a high level consolidation and the next move is normally given by a breakout up through the channel, or down through the channel.

David Morgan for

Stone Investment Group

Disclaimer

Information contained herein has been obtained from sources believed to be reliable, but there is no guarantee as to completeness or accuracy. Because individual investment objectives vary, this Summary should not be construed as advice to meet the particular needs of the reader. Any opinions expressed herein are statements of our judgment as of this date and are subject to change without notice. Any action taken as a result of reading this independent market research is solely the responsibility of the reader.

Stone Investment Group is not and does not profess to be a professional investment advisor, and strongly encourages all readers to consult with their own personal financial advisors, attorneys, and accountants before making any investment decision. Stone Investment Group and/or independent consultants or members of their families may have a position in the securities mentioned. Investing and speculation are inherently risky and should not be taken without professional advice.

By your act of reading this independent market research letter, you fully and explicitly agree that Stone Investment Group will not be held liable or responsible for any decisions you make regarding any information discussed herein.

-- Posted 15 April, 2004 | |