-- Posted 26 March, 2004 | | Source: SilverSeek.com

First they ignore you, then they laugh at you, then they fight you, then you win.

--Mahatma Gandhi

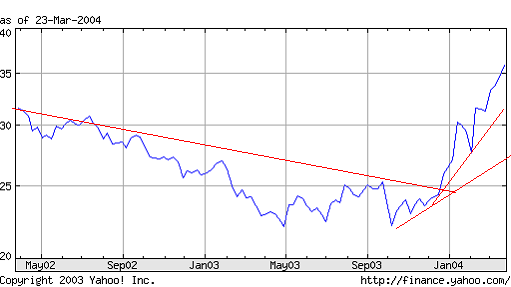

Silver in Argentinean Pesos

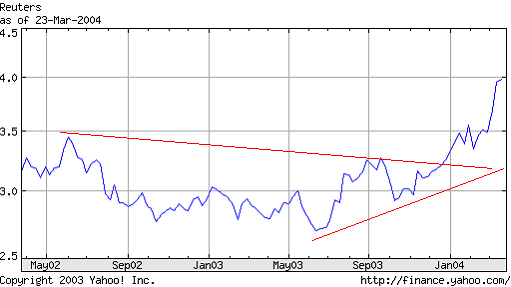

Botswana Pula

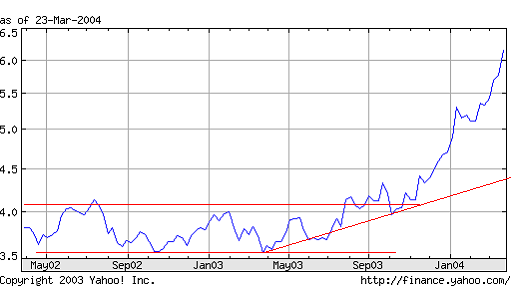

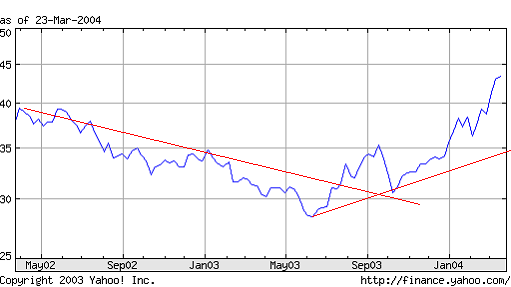

British Pound

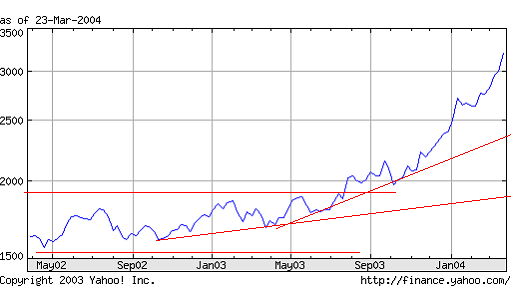

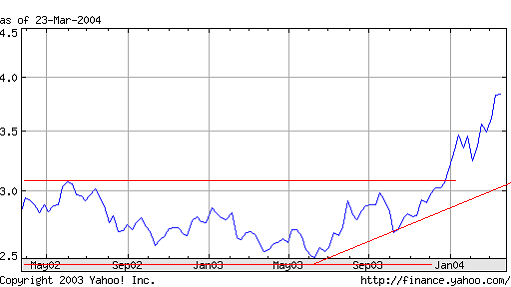

Canadian Dollar

Cayman Island Dollar

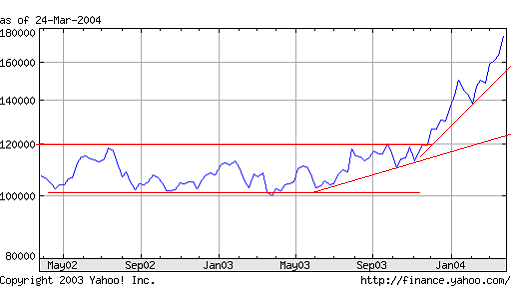

Costa Rica Colon

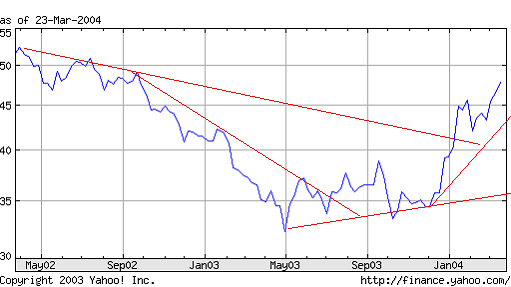

Czech Koruna

Danish Krone

Iceland Krona

Latvian Lat

Lesotho Loti

Mozambique Metical

South African Rand

Swiss Franc

Zambian Kwacha

Conclusion

I will leave it to my esteemed colleagues to put up some of very thought provoking numbers that will back what the charts are showing above. Unlike Gold, which is still not doing much in multiple currencies, Silver is breaking through all of them, indicating that it is in a true bull market. Its ironical that the poor mans gold is yielding better results than the rich mans gold. Now if thatís not contrarian I donít know what is? It looks like being a contrarian in every aspect of your life can be highly rewarding. Silver is going to be the truly wild card play and that is why since the middle of 2003 we became extremely bullish on this Metal and stated that it would out perform Gold. At that point in time we had no Idea that it would blast Gold into the dust so badly. Silver is currently the number one sector and has been so for the last 6 weeks and counting. The super trend has been set in motion and unlike Gold; Silver has reared its head in all almost all the major currencies. This is what is defined as true raging bull and any major pull backs should be seen as a gift from heaven to buy even more of this incredibly useful metal.

We will soon look at the final two other metals, Palladium and Platinum. As always take time to enjoy the Good things in life, for money cannot buy happiness it can only help you find new ways to extend your happiness. So make sure you know how to smile and enjoy the things that have no cost whatsoever attached to them.

A candle loses nothing by lighting another candle.

--Erin Majors

© 2004 Sol Palha

Tactical Investor

Email

Alan Lunt

Contributor

Tactical Investor

Well!!! What can I say? This is truly a bull market in silver. I had recently done the silver stocks to currency ratios and come to a similar conclusion to Sol. However what interests me more is that it looks like silver may have taken goldís place as a reserve currency. While the Central Banks and the Bullion Banks have been busy busting gold, silver has slowly but surely stolen the march. My gains in gold , up until the past two weeks, were negative in New Zealand dollar terms. But silver has been like a sleeping monolith, quietly stalking then overtaking all currencies. As much as the charts indicate real power up, I do suspect that the opposition is watching it carefully. Whether we get a short squeeze coming into the next contracts delivery I'm not sure. It will depend on the demand for delivery. Remember the shorts have access to huge pools of money, and it is that fiat money they will be trying to guard. They just cannot allow their brand of money to loose the battle to a "commodity". Be ready to man the trenches, the battle is on.

Alan Lunt

© 2004 Alan Lunt

www.tacticalinvestor.com

Email

George Paulos

Editor/Publisher

www.freebuck.com

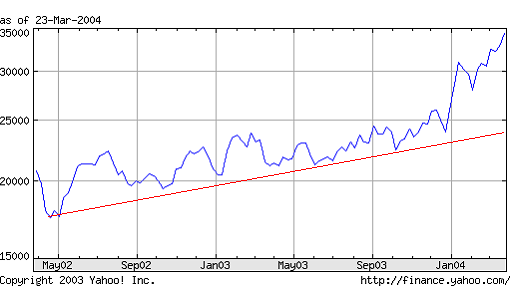

Iíd like to show one more chart that displays silver in terms of the ultimate currency: gold.

In terms of gold, silver has appreciated almost 40% in three months. If this isnít a breakout then I donít know what is. The strength and fury of this silver rally is breathtaking and it is supported by some of the strongest fundamentals in the whole commodity complex. Just to review the case for silver:

- Silver has been in a supply deficit for over a dozen years. This means that more silver is consumed than produced. The shortfall has been covered by drawing down the substantial stockpile of silver bullion that the US and other governments had amassed over the centuries.

- However, in 2002 the US exhausted its strategic stockpile of silver that contained over a billion ounces decades ago. This means that there are no substantial sources of stockpiled silver in the world. Analysts have estimated that the sum of private stockpiles (including COMEX and Warren Buffett stockpiles) is less that 500 million ounces (far less than gold stockpiles) and most of that is not available for sale except at much higher prices.

- Short silver contracts on the COMEX regularly exceed 300 million ounces with less than a third of that amount available on the exchange for delivery into these contracts. Theoretically a single large buyer could take delivery of the metal on a small percentage of contracts, effectively bankrupting the exchange and creating a huge spike in the silver price.

- Silver is an essential material for a wide range consumer, industrial, and military equipment. New uses are being found all the time. Some of the most promising new uses are in superconductivity and antibacterial technologies. Although essential, silver is an insignificant cost in most products. This makes demand for silver ďprice inelasticĒ, meaning that users will pay whatever the going price to obtain necessary supplies.

- NY Attorney General Elliot Spitzer has been alerted to possible illegal price manipulation in the silver futures market and an investigation may be forthcoming. A scandal in the silver pits may trigger a big price increase as the critical silver supply situation becomes widely known.

- There are very few primary silver deposits on the planet. Most of the silver mined in the world today is produced as a byproduct of base metals mining such as copper and nickel. Silver production for base metals miners is a sideline and does not contribute substantial revenues to their operations, so base metals miners arenít terribly excited by high silver prices and wonít increase production to exploit silver. This makes silver supply also ďprice inelasticĒ, meaning that an increase in price will not substantially increase supply from mines. A small number of primary silver mines also means that there is a very limited supply of silver mining stocks to choose from. Limited supply means huge price increases if investors try to pile into a small set of silver stocks during a bull market.

It is apparent to those few investors who have studied the metal that silver is one of the most undervalued assets on the planet. Even at these prices, silver is an astonishing bargain. Does it mean that silver is straight up from here? Of course not, but this move indicates the titanic forces brewing underneath the silver market that are now starting to become apparent.

Hiii-ooo silver!!

George Paulos

Email

Janice Dorn, M.D., Ph.D.

Contributor

Tactical Investor

As a medical student, I learned quickly that critical to accurate diagnosis is a complete History and Physical Examination, including a thorough Review of Systems. As the markets are nothing more than a large collection of human beings making financial decisions 24 hours a day, it seems appropriate to apply these principles.

So, as far as silver is concerned, let us look at the History:

Going back to 1986, the COT ( Commitment of Traders) data shows that commercials ( aka "smart money") have never carried more long contracts than short contracts. They have been net short. This so-called net-short ratio went as low as 0.5 in the summer of 1997, just prior to the so-called Warren Buffet rally.

Based upon this data, it is possible that we are witnessing a short squeeze in silver and that it may have further to go before what might be described as a "blow-off" top. Many are expecting this, and it would not be surprising if we could have a .50 or a 1.00 day in silver before it decides to settle down a bit. However, the charts that Sol has painstakingly presented indicate that silver is in a bull market in a variety of currencies. So, there is likely more to this picture than a short squeeze (although the importance of this cannot be minimized)

Now- on to the Physical and Review Of Systems:

The silver continuous contract ( $SILVER) has gone, essentially, parabolic; from a nadir of 4.5 in July 2003 to a close of 7.57 on March 24. This represents a stunning 68.2 percentage increase.

A cyclical recovery in both stocks and commodities has been in strong evidence for over a year now. Under these circumstances, silver has performed with the industrial metals, all of which have had good rises over the past year. There is no reason to think that silver will not correct when the base metals do ( which they will do when global economic conditions begin to worsen and global stock markets begin to weaken and turn down). After all, nothing goes straight up ( or down). However, silver is more than a base metal. It has monetary value. For that reason, it may not correct to the same degree that the other base metals will. In fact, it would be expected that silver and gold will once again begin to trade in tandem, and that the gold/silver ratio, which has fallen steadily since the beginning of 2004, will once again rise. At this point, silver is likely to decouple from the base metals and begin to trade as currency.

Much of the outcome here is, of course, unknown. It does appear, however, that the silver bull has a long way to run and anyone on board must be prepared to ride the ups and downs, knowing that the end is truly a silver lining.

© 2004 Janice Dorn, M.D., Ph.D.

www.tacticalinvestor.com

Email

-- Posted 26 March, 2004 | |